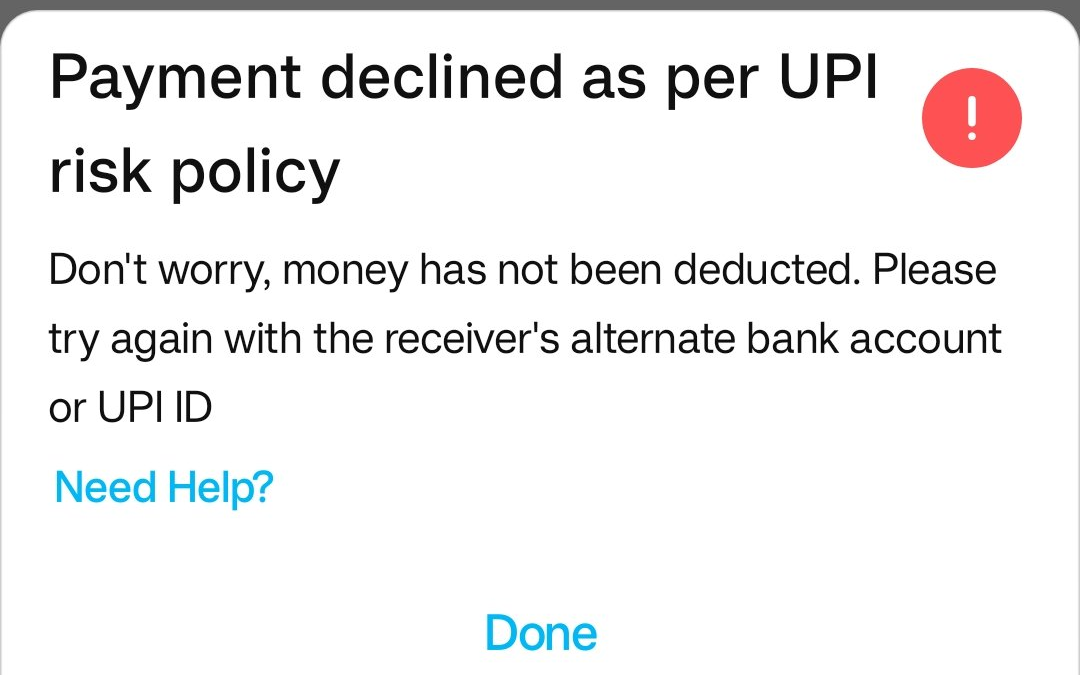

Facing payment issues can be irritating, but it’s important to ensure the security and integrity of transactions. Let’s explore some common reasons for and how you can resolve “Payment Declined as Per UPI risk policy” issue.

Your payment was declined as per UPI risk policy

1. Insufficient Funds

The most common reason for a declined UPI payment is insufficient funds in the linked bank account. Ensure that your account has enough balance to cover the transaction amount.

2. Incorrect UPI PIN

Entering the wrong UPI PIN can also result in a declined payment. Double-check that you have entered the correct UPI PIN when prompted during the payment process.

3. Payment Limits

Some banks or UPI apps impose daily transaction limits. Verify that your payment amount doesn’t exceed these limits.

4. Technical Glitches

Temporary technical issues can occur on the payment gateway’s side or the UPI app. In such cases, waiting for a while and trying the payment again later might resolve the issue.

5. Blocked Accounts

In certain cases, banks may block UPI payments due to suspicious activities or security concerns. Reach out to your bank’s customer support to inquire about any potential issues with your account.

6. Invalid UPI ID

Ensure that you have entered the correct UPI ID or VPA (Virtual Payment Address) of the recipient. A typo in the UPI ID can lead to a failed transaction.

7. Expired UPI Collect Request

If you are making a payment in response to a UPI collect request, make sure it is still valid and hasn’t expired.

To resolve the payment decline, you can take the following steps:

- Confirm your bank account balance to ensure sufficient funds for the transaction.

- Recheck the UPI PIN and ensure it’s accurate.

- Verify if there are any daily transaction limits imposed by your bank and adjust the payment amount accordingly.

- Wait for a while and try the payment again later, as technical glitches may be temporary.

- Contact your bank’s customer support to inquire about any blocks on your account or other payment issues.

If the problem persists, consider using an alternative payment method or consult with the recipient to explore other payment options.

Remember to keep your transaction details and personal information secure during any payment process to avoid potential risks or fraud. If you encounter any suspicious activity or unauthorized transactions, report it to your bank immediately.

Final Words

Declined UPI payments can occur due to various reasons, but most issues can be resolved by double-checking the necessary details and ensuring sufficient funds.

If the problem persists, don’t hesitate to seek assistance from your bank’s customer support.